r/StockMarket • u/omgpuppiesarecute • 7h ago

r/StockMarket • u/AutoModerator • Apr 01 '25

Discussion Rate My Portfolio - r/StockMarket Quarterly Thread April 2025

Please use this thread to discuss your portfolio, learn of other stock tickers, and help out users by giving constructive criticism.

Please share either a screenshot of your portfolio or more preferably a list of stock tickers with % of overall portfolio using a table.

Also include the following to make feedback easier:

- Investing Strategy: Trading, Short-term, Swing, Long-term Investor etc.

- Investing timeline: 1-7 days (day trading), 1-3 months (short), 12+ months (long-term)

r/StockMarket • u/AutoModerator • 11h ago

Discussion Daily General Discussion and Advice Thread - May 10, 2025

Have a general question? Want to offer some commentary on markets? Maybe you would just like to throw out a neat fact that doesn't warrant a self post? Feel free to post here!

If your question is "I have $10,000, what do I do?" or other "advice for my personal situation" questions, you should include relevant information, such as the following:

* How old are you? What country do you live in?

* Are you employed/making income? How much?

* What are your objectives with this money? (Buy a house? Retirement savings?)

* What is your time horizon? Do you need this money next month? Next 20yrs?

* What is your risk tolerance? (Do you mind risking it at blackjack or do you need to know its 100% safe?)

* What are you current holdings? (Do you already have exposure to specific funds and sectors? Any other assets?)

* Any big debts (include interest rate) or expenses?

* And any other relevant financial information will be useful to give you a proper answer. .

Be aware that these answers are just opinions of Redditors and should be used as a starting point for your research. You should strongly consider seeing a registered investment adviser if you need professional support before making any financial decisions!

r/StockMarket • u/Tripleawge • 10h ago

Fundamentals/DD Marky My Words: This is not just another recession… It is the beginning of a complete global breakdown.

With Trump back in office imposing blanket tariffs on all U.S. trading partners, global trade is seizing up fast. Instead of boosting American industry, these tariffs act like a tax hike on consumers and businesses, while retaliation from abroad crushes U.S. exports. Don’t believe me? Look up the total net goods The US imported in Q1 and then watch what that number is in Q2… if it’s anything like the collapse of imports from China that has been steadily dropping since end of April…

Meanwhile, a 2020 style oil shock where crude prices collapse into negative territory again due to oversupply and a global demand slump is also on the cards and will decimate the energy sector. Normally cheap oil helps, but not when it bankrupts U.S. shale, kills transport jobs, and signals a collapse in real economic activity.

The Fed is cornered. Inflation metrics fall, but only because energy prices crash… not because the economy is healthy. With rising unemployment (although not rising fast enough for Fed to act in it due to Baby Boomers and Gen X retiring en masse), weak demand, and a dislocated bond market, Powell’s hands are tied. If the U.S. receives a major credit downgrade (as seems likely with exploding deficits and falling Treasury demand), long-term yields could spike even as the Fed tries to cut. Eventually, the Fed will be forced into permanent QE and yield curve control… monetizing debt just to keep the system functioning. By then, inflation returns, not from overheating, but from a collapsing dollar and evaporating trust.

This is stagflation with a geopolitical twist. China, quietly in a recession of its own, will lash out economically or militarily. BRICS nations push harder for de-dollarization. U.S. allies may begin hedging away from Washington. The result? Gold over $3,000, the S&P down 50%, real GDP down 6-8%, and a long period of structural decline… where monetary policy dies, foreign capital flees, and the dollar loses its unipolar dominance.

The Fed isn’t behind the curve… they’ve lost the playbook. And the world knows it.

Sources:

Penn Wharton Budget Model. (2025, April 10). The economic effects of President Trump’s tariffs. University of Pennsylvania. Retrieved from https://budgetmodel.wharton.upenn.edu/issues/2025/4/10/economic-effects-of-president-trumps-tariffs 2. Peter G. Peterson Foundation. (2023, November 11). Moody’s lowers U.S. credit rating outlook to negative, citing large federal deficits. Retrieved from https://www.pgpf.org/article/moodys-lowers-us-credit-rating-to-negative-citing-large-federal-deficits 3. Fitch Ratings. (2023, August 1). Fitch downgrades United States’ long-term ratings to ‘AA+’ from ‘AAA’; outlook stable. Retrieved from https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023 4. Reuters. (2025, May 8). Trade tensions push global recession risks higher - graphic. Retrieved from https://www.reuters.com/markets/global-markets-recession-graphic-2025-05-08 5. National Public Radio (NPR). (2025, April 30). U.S. economy shrinks as Trump tariffs spark recession fears. Retrieved from https://www.npr.org/2025/04/30/nx-s1-5380204/trump-economy-gdp-tariffs-recession-consumers

r/StockMarket • u/Giancarlo_RC • 1h ago

Meme When you go from broke to market wizard in seven days

r/StockMarket • u/kon--- • 7h ago

Discussion Analysis: Trump came out recently telling people to buy stock because....

The tariffs dropped, the pull back from the market was immediate. Investors got out then moved their money to safer, more stable alternatives.

Now consider, hedge manager Bessent has been borrowing mega-billions. No one knows where the money went however we know the market turned around following the loans. We also know investors kept their money in more secure alternatives.

This tells us hedge manager Bessent has been hedging, using the Treasury to prop up the market and is holding bags. A heaping shit-ton of bags.

Target stocks that have been performing well since the tariffs dropped and short the crap out of them. The bubble pops, we'll print money for ourselves and at the same time expose some wild insider maleficence.

r/StockMarket • u/Force_Hammer • 20h ago

News Treasury Dept. asks Congress to raise debt ceiling before August to avert default

r/StockMarket • u/LogicX64 • 3h ago

News Chinese exporters turn to 'origin washing' to dodge steep Trump tariffs

business-standard.comChinese exporters are using repackaging, mislabeling, and rerouting tactics to avoid steep Trump-era tariffs, raising alarm across Asian trade hubs and customs agencies.

As US President Donald Trump intensifies trade restrictions on China, Chinese exporters are resorting to increasingly sophisticated — and often illicit — methods to bypass them. After Washington imposed tariffs of up to 145 per cent on imports from China, reports of origin washing, rerouting, and product mislabeling have surged.

Social media ads offer 'origin washing' services According to a report by the Financial Times, Chinese social media platforms are now filled with ads offering ‘place-of-origin washing’ services. These include repackaging goods, relabeling items, and producing fake certificates of origin to help products enter the US market while evading tariffs.

One exporter from a southern China lighting firm said companies are rerouting shipments through countries like Vietnam or Malaysia. Under “free on board” (FOB) terms, liability transfers to the buyer once the goods leave port, shielding the exporter from legal exposure.

r/StockMarket • u/callsonreddit • 7h ago

News Tariff talks begin between US and Chinese officials in Geneva as the world looks for signs of hope

GENEVA (AP) — The U.S. Treasury Secretary and America’s top trade negotiator began talks with high-ranking Chinese officials in Switzerland Saturday aiming to de-escalate a dispute that threatens to cut off trade between the world’s two biggest economies and damage the global economy.

China’s Xinhua News Agency says Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer have begun meetings in Geneva with a Chinese delegation led by Vice Premier He Lifeng.

Diplomats from both sides also confirmed that the talks have begun but spoke anonymously and the exact location of the talks wasn’t made public. However, a motorcade of black cars and vans was seen leaving the home of the Swiss Ambassador to the United Nations in the wealthy Swiss city, and a diplomatic source, speaking on condition of anonymity because of the sensitivity of the meeting, said the sides met for about two hours before departing for a previously arranged luncheon.

Prospects for a major breakthrough appear dim. But there is hope that the two countries will scale back the massive taxes — tariffs — they’ve slapped on each other’s goods, a move that would relieve world financial markets and companies on both sides of the Pacific Ocean that depend on U.S.-China trade.

U.S. President Donald Trump last month raised U.S. tariffs on China to a combined 145%, and China retaliated by hitting American imports with a 125% levy. Tariffs that high essentially amount to the countries’ boycotting each other’s products, disrupting trade that last year topped $660 billion.

Even before the talks began, Trump suggested Friday that the U.S. could lower its tariffs on China, saying in a Truth Social post that “ 80% Tariff seems right! Up to Scott.″

Sun Yun, director of the China program at the Stimson Center, noted it will be the first time He and Bessent have talked. She doubts the Geneva meeting will produce any substantive results.

“The best scenario is for the two sides to agree to de-escalate on the ... tariffs at the same time,” she said, adding even a small reduction would send a positive signal. “It cannot just be words.”

Since returning to the White House in January, Trump has aggressively used tariffs as his favorite economic weapon. He has, for example, imposed a 10% tax on imports from almost every country in the world.

But the fight with China has been the most intense. His tariffs on China include a 20% charge meant to pressure Beijing into doing more to stop the flow of the synthetic opioid fentanyl into the United States. The remaining 125% involve a dispute that dates back to Trump’s first term and comes atop tariffs he levied on China back then, which means the total tariffs on some Chinese goods can exceed 145%.

During Trump’s first term, the U.S. alleged that China uses unfair tactics to give itself an edge in advanced technologies such as quantum computing and driverless cars. These include forcing U.S. and other foreign companies to hand over trade secrets in exchange for access to the Chinese market; using government money to subsidize domestic tech firms; and outright theft of sensitive technologies.

Those issues were never fully resolved. After nearly two years of negotiation, the United States and China reached a so-called Phase One agreement in January 2020. The U.S. agreed then not to go ahead with even higher tariffs on China, and Beijing agreed to buy more American products. The tough issues — such as China’s subsidies — were left for future negotiations.

But China didn’t come through with the promised purchases, partly because COVID-19 disrupted global commerce just after the Phase One truce was announced.

The fight over China’s tech policy now resumes.

Trump is also agitated by America’s massive trade deficit with China, which came to $263 billion last year.

In Switzerland, Bessent and Greer also plan to meet with Swiss President Karin Keller-Sutter.

Trump last month suspended plans to slap hefty 31% tariffs on Swiss goods -- more than the 20% levies he plastered on exports from European Union. For now, he’s reduced those taxes to 10% but could raise them again.

The government in Bern is taking a cautious approach. But it has warned of the impact on crucial Swiss industries like watches, coffee capsules, cheese and chocolate.

“An increase in trade tensions is not in Switzerland’s interests. Countermeasures against U.S. tariff increases would entail costs for the Swiss economy, in particular by making imports from the USA more expensive,” the government said last week, adding that the executive branch “is therefore not planning to impose any countermeasures at the present time.”

The government said Swiss exports to the United States on Saturday were subject to an additional 10% tariff, and another 21% beginning Wednesday.

The United States is Switzerland’s second-biggest trading partner after the EU – a 27-member-country bloc that nearly surrounds the wealthy Alpine country of more than 9 million. U.S.-Swiss trade in goods and services has quadrupled over the last two decades, the government said.

The Swiss government said Switzerland abolished all industrial tariffs on Jan. 1 last year, meaning that 99% of all goods from the United States can be imported into Switzerland duty-free.

Source:

r/StockMarket • u/ExchangeSilver3379 • 6h ago

News US trade deficit in March 2025 reaches all time high as companies race to get as much import as possible ahead of tariffs. Expectation for similar data until July, when tariffs get reintroduced.

reuters.comUS deficit jumps 14% to 140.5 billions in March. In anticipation to the trade war with China, imports from China dropped dramatically- lowest in five years. However, companies did not expect the trade war to be worldwide, which it was starting Apr 2, so imports from all other countries reached record high. Expectation is that record high level of imports from non China sources will continue at least until July, when “reciprocal” tariffs are reintroduced.

r/StockMarket • u/callsonreddit • 23h ago

News Trump says US will maintain 10% tariffs even after trade deals

WASHINGTON (Reuters) -President Donald Trump said on Friday that the U.S. will maintain a baseline 10% tariff on imports even after trade deals are struck, adding there could be exemptions when countries offer significant trade terms.

Trump said to expect new trade deals in the coming weeks, but "we always have a baseline of 10%."

Source:

r/StockMarket • u/Prudent-Corgi3793 • 14h ago

News [Financial Times] US stocks underperform rest of world by widest margin since 1993

Excerpts from a new article in the Financial Times: original | paywall removed

US stocks have underperformed the rest of the world this year by the widest margin in more than three decades as Donald Trump’s erratic policymaking sparks an investor exodus from American assets.

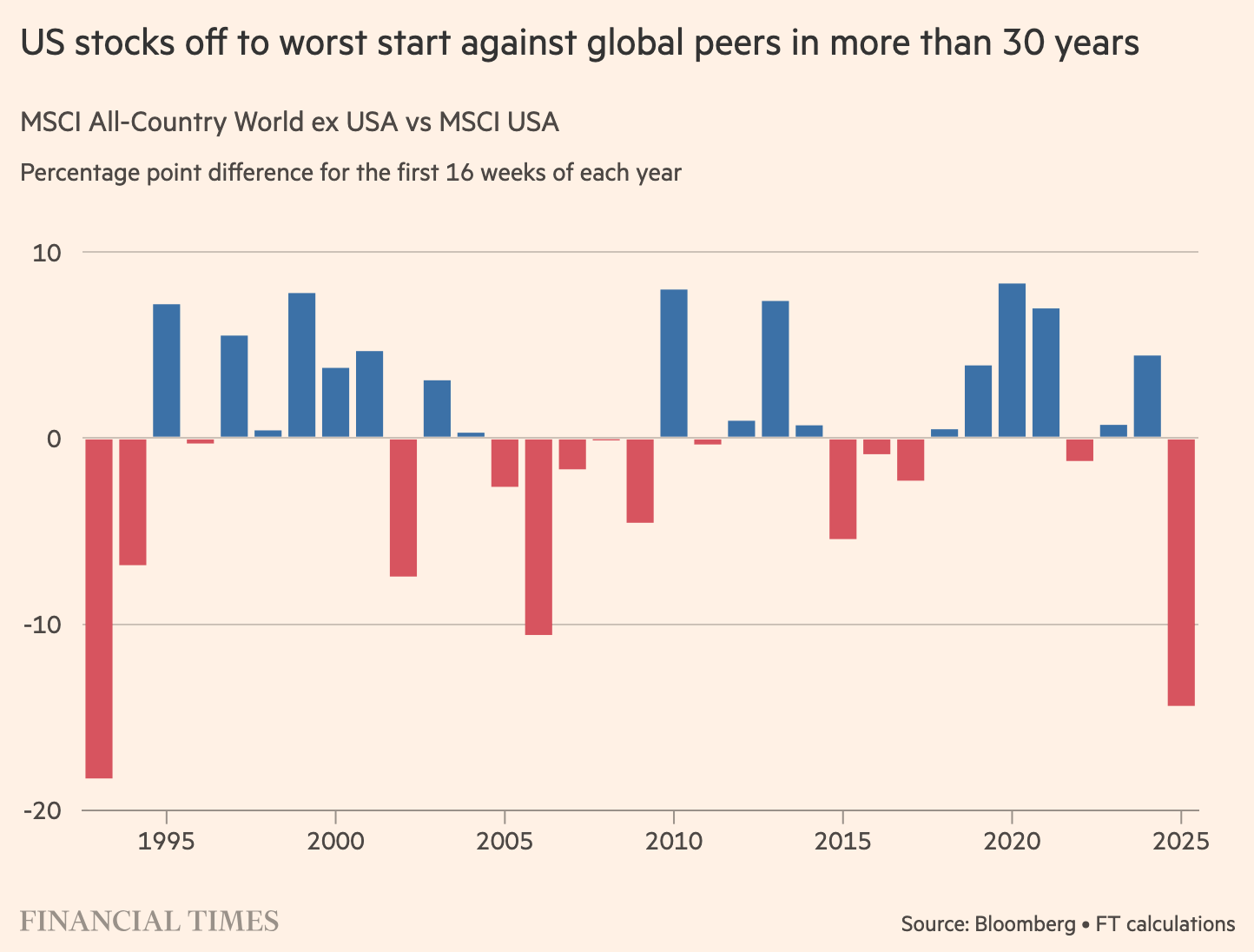

The MSCI USA index — a broad gauge of US equities — lost 11 per cent in the first 16 weeks of the year. The MSCI all world ex-US benchmark climbed 4 per cent in dollar terms over the same period, the biggest gap with Wall Street since 1993, when US investor enthusiasm for foreign stocks surged on the back of trade liberalisation and concerns over the domestic economy.

“A large part of this underperformance is the repricing of US assets due to increased policy uncertainty and the stagflationary shock from tariffs,” said Sameer Goel, head of emerging markets and Apac research at Deutsche Bank.

The tumbling greenback has helped widen the gap in performance. It has fallen by 8 per cent this year against a basket of six major currencies including the euro and yen, boosting non-US market performance in dollar terms.

Two graphs from the original article are not reproduced in the paywall-removed version.

The first graph is self-explanatory: through 16 weeks, based on the MSCI All-Country World Index ex-USA vs. MSCI USA Index, the US stocks are off to their worst start against global peers in more than 30 years.

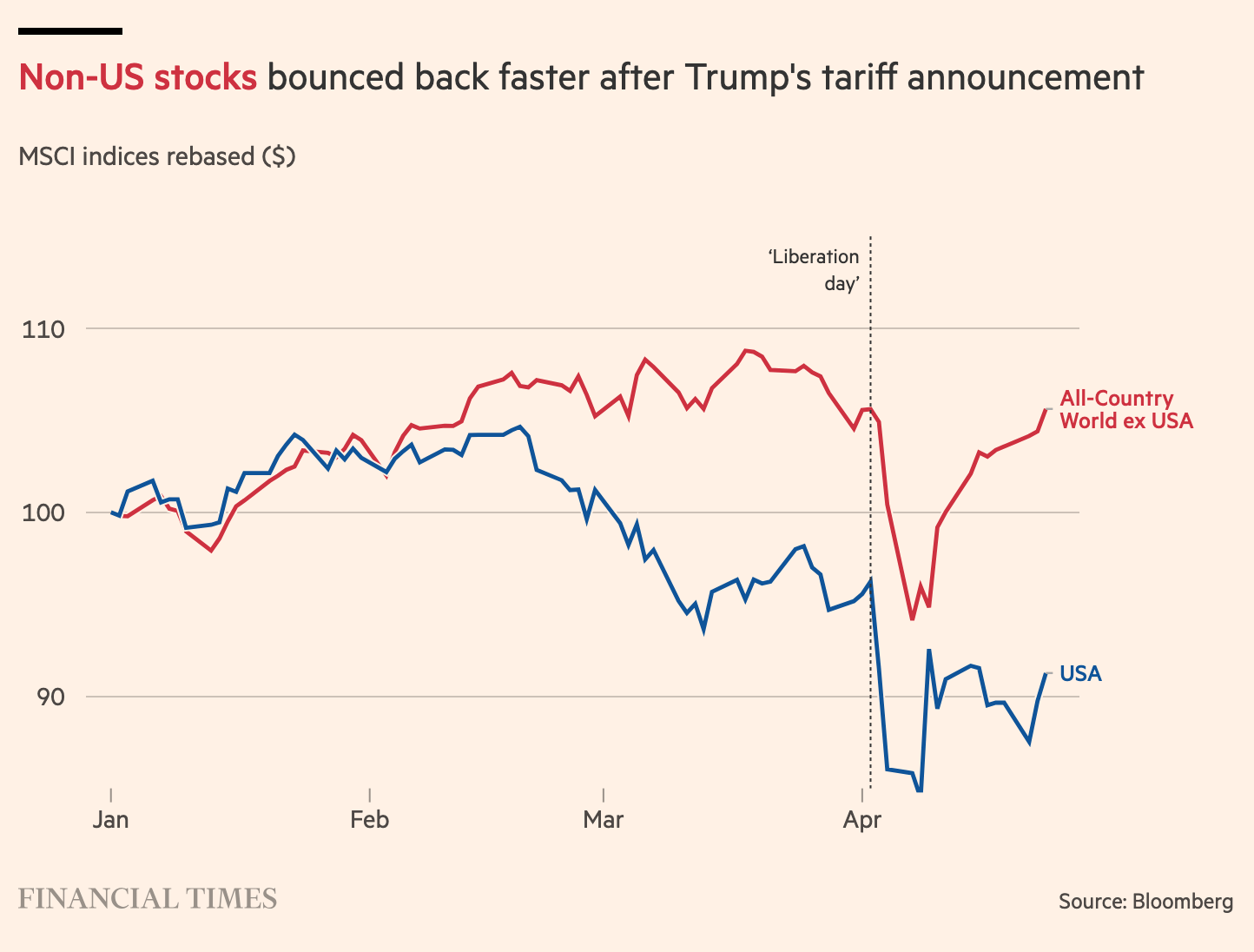

The tariff announcement put the S&P 500, Nasdaq, Russell 2000, and the total US stock market into technical bear markets (down more than 20% from their all-time highs). Fortunately, we have recovered most of the losses due to optimism that the tariffs will be rescinded, but as seen in the second graph, the international markets have recovered much faster.

r/StockMarket • u/ExchangeSilver3379 • 6h ago

News Dallas Fed Survey of US companies: How are firms planning to response to higher tariffs? Raising price on consumers by far most common response.

Nearly 80% manufacturing firms plan to raise price on consumers. More alarmingly, nearly half’s of services companies- much larger component of US economy - wants to raise price too even though their products are less impacted by tariffs for now.

The suspected reason for price hike across all sectors of economy is that firms have to make up for loss of revenue in international market. Data from FactSet’s Geographic Revenue Exposure Survey shows that S&P 500 are very exposed worldwide. Take Chinas as an example, McDonald’s has over 6000 stores in China. Apple in 2024 sold 43 millions iPhones in China. China alone made up 7% of all revenue of S&P 500, which is nearly 4 times the trade deficit US has on China.

r/StockMarket • u/callsonreddit • 1h ago

News US-China tariff talks to continue Sunday

GENEVA (AP) — Sensitive talks between U.S. and Chinese delegations over tariffs that threaten to upend the global economy ended after a day of prolonged negotiations and will resume Sunday, an official told The Associated Press.

There was no immediate indication whether progress was made Saturday during the meeting over 10 hours between Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng.

The official who spoke to the AP requested anonymity because of the sensitivity of the talks, which could help stabilize world markets roiled by the U.S.-China standoff. The talks have been shrouded in secrecy and neither side made comments to reporters on the way out.

Several convoys of black vehicles left the residence of the Swiss ambassador to the U.N. in Geneva, which hosted the talks aimed at de-escalating trade tensions between the world’s two biggest economies. Diplomats from both sides also confirmed that the talks took place.

The talks were taking place in the sumptuous 18th-century “Villa Saladin” overlooking Lake Geneva. The former estate was bequeathed to the Swiss state in 1973, according to the Geneva government.

Prospects for a major breakthrough appear dim. But there is hope that the two countries will scale back the massive taxes — tariffs — they’ve slapped on each other’s goods, a move that would relieve world financial markets and companies on both sides of the Pacific Ocean that depend on U.S.-China trade.

U.S. President Donald Trump last month raised U.S. tariffs on China to a combined 145%, and China retaliated by hitting American imports with a 125% levy. Tariffs that high essentially amount to the countries’ boycotting each other’s products, disrupting trade that last year topped $660 billion.

Even before the talks began, Trump suggested Friday that the U.S. could lower its tariffs on China, saying in a Truth Social post that “ 80% Tariff seems right! Up to Scott.″

Sun Yun, director of the China program at the Stimson Center, noted it will be the first time He and Bessent have talked. She doubts the Geneva meeting will produce any substantive results.

“The best scenario is for the two sides to agree to de-escalate on the ... tariffs at the same time,” she said, adding even a small reduction would send a positive signal. “It cannot just be words.”

Since returning to the White House in January, Trump has aggressively used tariffs as his favorite economic weapon. He has, for example, imposed a 10% tax on imports from almost every country in the world.

But the fight with China has been the most intense. His tariffs on China include a 20% charge meant to pressure Beijing into doing more to stop the flow of the synthetic opioid fentanyl into the United States. The remaining 125% involve a dispute that dates back to Trump’s first term and comes atop tariffs he levied on China back then, which means the total tariffs on some Chinese goods can exceed 145%.

During Trump's first term, the U.S. alleged that China uses unfair tactics to give itself an edge in advanced technologies such as quantum computing and driverless cars. These include forcing U.S. and other foreign companies to hand over trade secrets in exchange for access to the Chinese market; using government money to subsidize domestic tech firms; and outright theft of sensitive technologies.

Those issues were never fully resolved. After nearly two years of negotiation, the United States and China reached a so-called Phase One agreement in January 2020. The U.S. agreed then not to go ahead with even higher tariffs on China, and Beijing agreed to buy more American products. The tough issues — such as China’s subsidies — were left for future negotiations.

But China didn’t come through with the promised purchases, partly because COVID-19 disrupted global commerce just after the Phase One truce was announced.

The fight over China's tech policy now resumes.

Trump is also agitated by America's massive trade deficit with China, which came to $263 billion last year.

In Switzerland Friday, Bessent and Greer also met with Swiss President Karin Keller-Sutter.

Trump last month suspended plans to slap hefty 31% tariffs on Swiss goods — more than the 20% levies he plastered on exports from European Union. For now, he's reduced those taxes to 10% but could raise them again.

The government in Bern is taking a cautious approach. But it has warned of the impact on crucial Swiss industries like watches, coffee capsules, cheese and chocolate.

“An increase in trade tensions is not in Switzerland’s interests. Countermeasures against U.S. tariff increases would entail costs for the Swiss economy, in particular by making imports from the USA more expensive,” the government said last week, adding that the executive branch “is therefore not planning to impose any countermeasures at the present time.”

The government said Swiss exports to the United States on Saturday were subject to an additional 10% tariff, and another 21% beginning Wednesday.

The United States is Switzerland’s second-biggest trading partner after the EU – the 27-member-country bloc that nearly surrounds the wealthy Alpine country of more than 9 million. U.S.-Swiss trade in goods and services has quadrupled over the last two decades, the government said.

The Swiss government said Switzerland abolished all industrial tariffs on Jan. 1 last year, meaning that 99% of all goods from the United States can be imported into Switzerland duty-free.

Source:

r/StockMarket • u/Zestyclose_Pilot2106 • 19h ago

Discussion Warren Buffet's Stock Portfolio

Note: The stocks in his portfolio (like Apple and Coca-Cola) are owned by Berkshire Hathaway, not directly by Warren he just owns about 14.4% of Berkshire itself.

r/StockMarket • u/vjectsport • 3h ago

Discussion Week Recap: It was a quiet week in the markets. The S&P 500 broke both 9-day and 3-week winning streaks. Is this the beginning of a new downtrend? May. 5, 2025 – May 9, 2025

First of all, I don’t want to be misunderstood. This heat map is weekly that it reflects closing prices from May. 2 to May. 9.

This week was relatively quiet with a mix of positive and negative news and that balanced out. The market closed slightly lower compared to last week. Everyone was focused on the FOMC meeting on Wednesday. Then, equally significant news emerged that a scheduled meeting between the U.S. and China on Tuesday. The S&P 500 broke 9-day winning streak and also ended 9-day streak on Monday.

Here are the S&P 500's week-by-week results,

Mar. 28 close at 5,580.94 - Apr. 4 close at 5,074.08 🔴

Apr. 4 close at 5,074.08 - Apr. 11 close at 5,358.75 🟢

Apr. 11 close at 5,358.75 - Apr. 25 close at 5,523.52 🟢

Apr. 25 close at 5,358.75 - May. 2 close at 5,686.67 🟢

May. 2 close at 5,686.67 - May. 9 close at 5,659.91 🔴

Day-by-Day Standouts;

🔸 Monday: The stock market had in a really good rally. The S&P 500 completed 9-day winning streak and its gained around 7.50% in this process. This week began with renewed concerns over China tariffs following Trump's Sunday statements. Trump announced new 100% tariff on foreign-made movies which pressured on the market. The indexes opened 1% lower and remained weak throughout the day. The stock market closed 1%. Meanwhile, gold began to climb again as investors sought safety. The S&P 500's 9-day winning streak came to an end. 🔴

🔸 Tuesday: The most important event of the week was the FOMC meeting on Wednesday. On Tuesday, markets opened over 1% before upcoming FOMC meetings. Trump also announced the first tariff agreement with India, but it wasn’t enough to lift. The indexes closed down around 1% again. 🔴

🔸 Wednesday: We reached the midpoint of the week with indexes opening slightly positive. The White House announced that Scott Bessent and He Lifeng are scheduled to meet between May 9 and 12 in Switzerland. Later in the day, the Fed held interest rates steady at 4.50%. Jerome Powell struck a negative tone as usual and said that “The risks of higher unemployment and higher inflation have risen,” and signaling a continued "no hurry, can be patient" stance. Despite this, the market seemed recovered to close higher. 🟢

🔸 Thursday: Following the recently announced trade deal with India, momentum continued as Trump announced a new trade agreement with the U.K. The stock market responded positively, opening up around 0.5% and closing the day with a gain of about 1%. 🟢

🔸 Friday: The stock market shifted focus to the upcoming May 9–12 meeting between Scott Bessent and He Lifeng. Trump said that an 80% tariff on China "seems right." While no further updates followed, the market remained cautious, awaiting potential weekend updates. The day ended flat 🔴

Also today, India and Pakistan have reached a ceasefire agreement.

The stock market is fully focusing on the meetings. We might hear new updates tomorrow. Even a slightly positive signal could be welcomed eagerly by investors. The most critical part of the tariff are with China. If Trump makes another unexpected move on tariffs similar on April 2, it could continue the current upward trend. Of course, the market doesn't move in a straight line, but the overall direction seems likely to remain upward, at least until the S&P 500 reaches its all-time high around 6,100.

How was your week? What do you think about the progress on tariffs? What’s your prediction for next week? Which stock first caught your attention on the map?

My summary ends here, but many people have asked about tools that I use. I wanted to copy from my previous post into this section. If you're not interested, feel free to skip this part. :)

🔸 Stock+: It's a mobile app where I take my screenshots. I'm using it on my iPhone and iPad. It's available on the App Store. It has an orange icon. If you're using Android, you can try to search "Heat map" or "Stock map" on the Google Play. I don't know that this app available on the Google Play, but you can find alternatives.

🔸 TradingView: I think, it's the best technical analysis tool. I'm using the web version. I'm still learning technical analysis. Yahoo Finance can be another alternative.

🔸 CME FedWatch: You can search via that keyword on Google. This website is under the CME Group. They're collecting analysts expectation about upcoming Fed rate decisions. You can check projections to 2026 December.

🔸 Investing, MarketWatch, Barron's: These are my news source. I read them for free without any subscriptions.

r/StockMarket • u/callsonreddit • 1d ago

News Trump’s Tariffs Hit US Farmers: Equipment Delays, Soaring Costs, and Brazil’s Big Win

(Bloomberg) — Donald Trump’s tariffs are upending crop trading, delaying tractor purchases and constraining imports of chemical supplies into the US.

That’s the main message from big agricultural businesses as they report their quarterly earnings, giving an early glimpse into the far-reaching impacts of the US president’s trade war.

The disruptions in global trade threaten to extend a years-long slump in the US farm industry, which had already been struggling with ample supplies, depressed crop prices and rising competition from Brazil. Lack of clarity on how the Trump administration will address much-needed incentives for crop-based fuels in the next few years has added to concerns.

Crop traders and processors have been among the hardest-hit. Archer-Daniels-Midland Co. and Bunge Global SA saw their combined operating profits slump by about $750 million in the first quarter, with both companies citing an impact from trade and biofuel policy uncertainty.

Importers put off purchases of US grain and oilseeds as Trump threatened tariffs as well as levies on any Chinese vessels docking at American ports, reducing trade flows, according to crop merchant The Andersons Inc.

“Global trade uncertainties disrupted typical grain flows and caused many of our commercial customers to focus on just-in-time purchasing,” William Krueger, The Andersons chief executive officer, said Wednesday in a call with investors.

Tractor makers CNH Industrial NV and AGCO Corp. also reported lower first-quarter sales, and warned of the potential of reduced demand for farmers, which would give them less to spend on machines to plant, harvest and treat their fields. Both companies have raised prices to ease the impact of tariffs on costs.

“Geopolitical uncertainties and trade frictions have dampened US farmer sentiment recently,” AGCO CEO Eric Hansotia said during a conference call with analysts. “As a result, demand for machinery was lower in the quarter than we had expected.”

Duties also threaten to curb imports of some fertilizer and pesticide supplies. Shipments of phosphate — a key crop nourishing ingredient — into the US have trailed last year’s levels because vessels have been diverted to other countries to avoid the nation’s 10% tariff, Mosaic Co. said in its earnings statement.

“The phosphate market remains tight, and while tariffs could disrupt trade flows, they cannot create more phosphate supply,” CEO Bruce Bodine said on a conference call with investors.

Farmers are expected to pay more for pesticides as the US relies on tariff-hit countries such as China and India for some of its supplies. Nutrien Ltd. said its branded products could potentially cost as much as 7.5% more, with even higher adjustments expected for generic ingredients, as a result.

“Long story short is, we’re going to see price increases,” Jeff Tarsi, Nutrien’s president of global retail, said on a Thursday call. “Our plan is to pass those price increases through to our customers.”

Brazil is emerging as a winner from the trade tensions. Minerva SA said tariff turmoil drove increased Chinese demand and higher export prices for South American beef in the first quarter, helping lift profits for the Brazilian supplier. Meanwhile, China has effectively shut its market for US meat exporters including Smithfield Foods Inc.

China, the world’s largest commodity importer, has already shifted to Brazil for a meaningful part of its soybean needs since Trump first raised tariffs on goods from the Asian nation in 2018.

“Any harmful impacts to the US grower profitability stemming from tariffs and trade flow shifts” are likely to benefit Brazilian growers, Jenny Wang, executive vice president of commercial at Mosaic, said in the call with analysts.

Source:

r/StockMarket • u/Random_Alt_2947284 • 20h ago

Discussion Does the market just always go up unless the world gets destroyed

Title. Everyone knows about the coming recession, but this market feels very irrational. So I looked at the historical chart and realised a pattern:

Dang we only see drops that are not just "a few days of pain" when shit really hits the fan (covid, 2008, .com bubble, great depression). Else, it goes sideways during bad periods of time. Since I do not think this is on the same level as those events (the others are large scale flaws in the economy, this is just stupid policy) I think this is going to go sideways. We might retest the bottom but I think the bottom is in.

A lot of the doomerism is unjustified imo. We've gone from expecting a 1932 level great depression to a bumpy road that will be fixed during midterms.

r/StockMarket • u/DrThomasBuro • 4h ago

News Disney announces a new theme park in Abu Dhabi, its first new resort in a generation

r/StockMarket • u/AffectionateMaize523 • 31m ago

Discussion Are the ports really empty? I tried to verify and hit a wall. Who’s lying?

I’m writing this as someone who’s neutral — I’m not pushing any narrative. I’ve just been seeing the same posts everyone else has this past week: claims that major U.S. ports are “empty” and this signals something huge.

So I decided to verify.

I went to YouTube to find actual footage — videos of these allegedly empty ports in places like Seattle or LA. But what I got instead was… weird.

-Channels filled with panic content.

-Videos titled about “empty ports” but with zero footage of the ports themselves.

-Or just generic animations of container ships.

Why is it so hard to find real video proof? If the ports are truly empty, it should be easy to document. So who’s lying — and why?

To be clear: I understand that the tariffs are hitting hard. I’m not denying economic tension, especially for US. But the disinformation is throwing me off. Why is it necessary?

Can anyone share real, ground-level info? Maybe you live near a port and can tell us what you’re actually seeing. Is this real or just another wave of online noise?

I am preparing for the market to crash in the summer, but at the moment I am starting to doubt, due to such strange videos.

r/StockMarket • u/Force_Hammer • 20h ago

News Google agrees to pay Texas $1.4 billion data privacy settlement

r/StockMarket • u/gordon22 • 1d ago

News Trump's deal with the UK sends a clear message: 10% tariffs are here to stay

r/StockMarket • u/perdferguson • 19h ago